{{propApi.title}}

{{propApi.text}} {{region}} Change location{{propApi.title}}

{{propApi.successMessage}} {{region}} Change location{{propApi.title}}

{{propApi.text}} {{region}} Change location{{propApi.title}}

{{propApi.successMessage}} {{region}} Change locationConstruction loans remain elevated in August

Construction loans remain elevated in August

Member and guest login

Enter your email and password to access secured content, members only resources and discount prices.

Did you become a member online? If not, you will need to activate your account to login.

If you are having problems logging in, please call HIA helpdesk on 1300 650 620 during business hours.

Forgotten password

Need some help?

If you are having problems logging in, please call HIA helpdesk on 1300 650 620 during business hours.

If the email address you have entered is registered, you will receive an email with further instructions.

Become part of the HIA community

Enables quick and easy registration for future events or learning and grants access to expert advice and valuable resources.

Create a guest account

Enter your details below and create a login

“The number of loans for the construction of a new dwelling fell by 4.9 per cent in August but remains elevated compared to pre-COVID levels,” stated HIA Economist, Tom Devitt.

The ABS released the Lending to Households and Businesses data for August 2021 today. The publication presents statistics on housing finance commitments including for the purchase or construction of new dwellings.

“The number of loans for the construction of new homes has continued its decline since the end of HomeBuilder in March,” added Mr Devitt.

“Despite these declines, the number of loans still remains up by 51.0 per cent in the three months to August 2021 compared to the same period two years ago.

“This will ensure a solid pipeline of home building work and associated employment well into the second half of 2022.

“First home buyer activity has also remained elevated and they now account for 35 per cent of the market. This remains above the average of the last decade as they take advantage of record low interest rates.

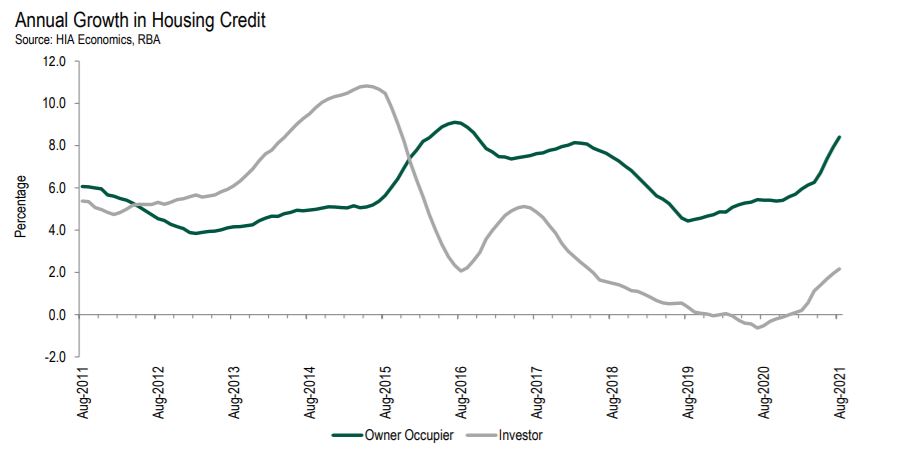

“Investor activity is also returning to long term trends with lending to investors rising by 1.5 per cent in August. Investors now account for almost one-third of the value of loans issued. This remains well below the peaks seen pre-COVID when macro-prudential restrictions were introduced.

“Lending for home renovations however, remains exceptionally high. The value of loans issued for renovations in the past three months is 122.7 per cent higher than the same period last year. This has been driven by record household savings and structural shifts as we spend more time at home,” concluded Mr Devitt.

Across the states, the number of loans to owner-occupiers for the construction of a new dwelling in the three months to August 2021 compared to the same time last year has increased in almost all jurisdictions:

- South Australia by +69.6 per cent

- The Australian Capital Territory by +61.3 per cent

- Western Australia by +48.0 per cent

- Tasmania by +44.2 per cent

- New South Wales by +27.8 per cent

- Victoria by +27.5 per cent

- Queensland by +20.0 per cent

- The Northern Territory is down by 48.0 per cent.

For further information please contact:

Tom Devitt, Economist 0439 514 656

Tim Reardon, Chief Economist 0423 141 031

Hunter builders among nation's largest

Three Hunter based builders once again were in the top 100 of Australia’s largest residential builders,” stated HIA Hunter Executive Director, Craig Jennion.

SafeWork targets scaffold safety

SafeWork NSW inspectors are out and about checking scaffolding safety as part of their Scaff Safe 2024 program that runs till December.

HIA welcomes announcement of HomeGrown grants (NT)

HIA welcomes the CLP Government’s announcement introducing the HomeGrown Territory Grant of $50,000 for first home buyers to put towards building a new home.

HomeGrown grants announced (NT)

The CLP Government has announced the HomeGrown Territory Grant of $50,000 for first home buyers to put towards building a new home, with applications starting on Tuesday 1 October.