{{propApi.title}}

{{propApi.text}} {{region}} Change location{{propApi.title}}

{{propApi.successMessage}} {{region}} Change location{{propApi.title}}

{{propApi.text}} {{region}} Change location{{propApi.title}}

{{propApi.successMessage}} {{region}} Change locationLending for new homes reaches decade low

Lending for new homes reaches decade low

Member and guest login

Enter your email and password to access secured content, members only resources and discount prices.

Did you become a member online? If not, you will need to activate your account to login.

If you are having problems logging in, please call HIA helpdesk on 1300 650 620 during business hours.

Forgotten password

Need some help?

If you are having problems logging in, please call HIA helpdesk on 1300 650 620 during business hours.

If the email address you have entered is registered, you will receive an email with further instructions.

Become part of the HIA community

Enables quick and easy registration for future events or learning and grants access to expert advice and valuable resources.

Create a guest account

Enter your details below and create a login

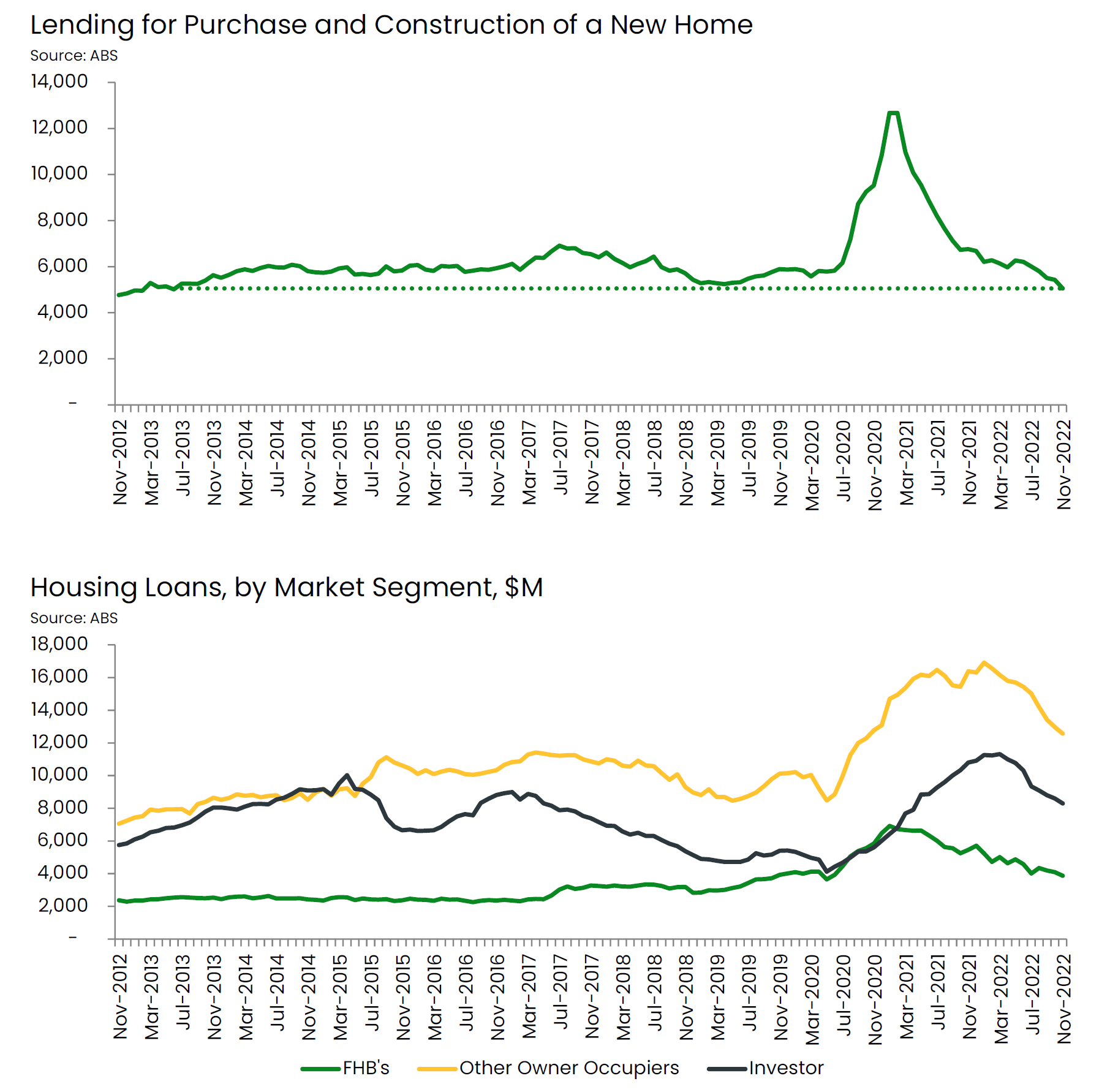

“There were only 5,057 loans for the construction or purchase of new homes in November, the weakest month since June 2013,” stated HIA Economist, Tom Devitt.

The ABS released the Lending to Households and Businesses data for November 2022 today.

“This reflects the very well broadcast housing downturn, with new housing loans over the 12 months to November 2022 down by 36.2 per cent on the preceding year,” added Mr Devitt.

“Investors and owner-occupiers, alike, are retreating from the market.

“This contraction in lending occurred before the RBA increased the cash rate in December and we expect an ongoing decline in lending as the full impact of the increase in interest rates flows through to households.

“There are long lags inherent in this cycle and the full impact of the increase in the cash rate in 2022 will not be observed until late in 2023.

“The RBA has already undertaken the steepest hiking cycle in a generation, and it needs to hold fire on further hikes to give their actions to date time to play out.

“The RBA will not restore the economy to stable growth by putting the building industry through boom-and-bust cycles.

“As building activity slows in 2023, the RBA will be under increasing pressure to reverse course in the second half of this year,” concluded Mr Devitt.

The number of loans for the construction or purchase of new homes declined in all jurisdictions in November 2022 compared to the same month in 2021, led by the Northern Territory (-58.3 per cent), and followed by the Australian Capital Territory (-39.7 per cent), Queensland (-30.8 per cent), Western Australia (-30.3 per cent), South Australia (-29.7 per cent), New South Wales (-26.8 per cent), Victoria (-15.2 per cent) and Tasmania (-7.4 per cent).

For more information please contact:

Crackdown needed as site theft adds to builders' insurance burden

The Housing Industry Association (HIA) has welcomed the Tasmanian Government’s move to crack down on copper and scrap metal theft, warning that construction site theft is adding to the risk that insurers are pricing into premiums for Tasmanian builders.

Infrastructure funding must drive new housing supply in Queensland

The Housing Industry Association (HIA) welcomes the Queensland Government’s continued investment in enabling infrastructure through Round 2 of the $2 billion Residential Activation Fund, but the funding must be tightly targeted to ensure it genuinely delivers new housing supply,” HIA Executive Director Queensland, Michael Roberts, said today.

Lifting taxes wont get more homes built

The Housing Industry Association (HIA) will be sending a simple message to the inquiry into Capital Gains Tax (CGT) on residential property when it appears before the Select Committee on the Operation of the Capital Gains Tax Discount tomorrow – if you tax something more, you will get less of it.

HIA welcomes Tasmanian Government's leadership on NCC pause

The Housing Industry Association (HIA) has today welcomed the Tasmanian Government’s finalisation of the Building Amendment Bill 2026, ahead of its imminent introduction to Parliament. The Bill will formally pause further implementation of new National Construction Code (NCC) requirements in Tasmania.